Residential Apartments Market Report

January–June 2025 vs January–June 2024

Summary

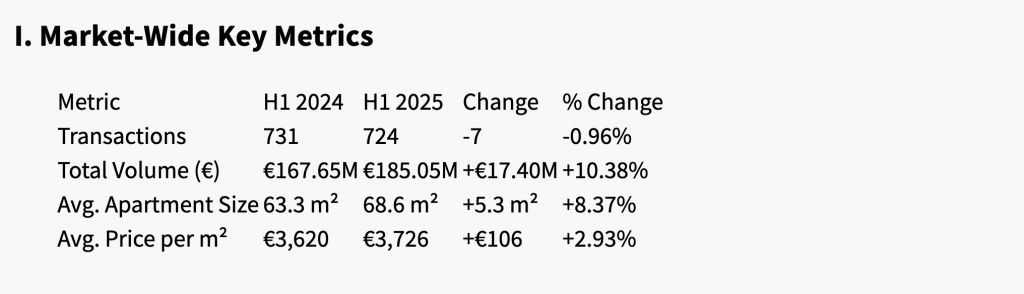

Tallinn residential apartments transactions brief overview from the first half of 2025. Kesklinn (city centre) residential apartment market demonstrated a notable shift in purchasing behavior. While total transaction volume declined marginally by 0.96%, the total value of sales increased by 10.38%, reflecting a clear movement toward larger and higher-priced units. The average apartment size grew by 8.37%, while the average price per square meter appreciated by 2.93%.

Conclusion: A market in consolidation — fewer but higher-value transactions, with a strong tilt toward premium subdistricts and spacious units.

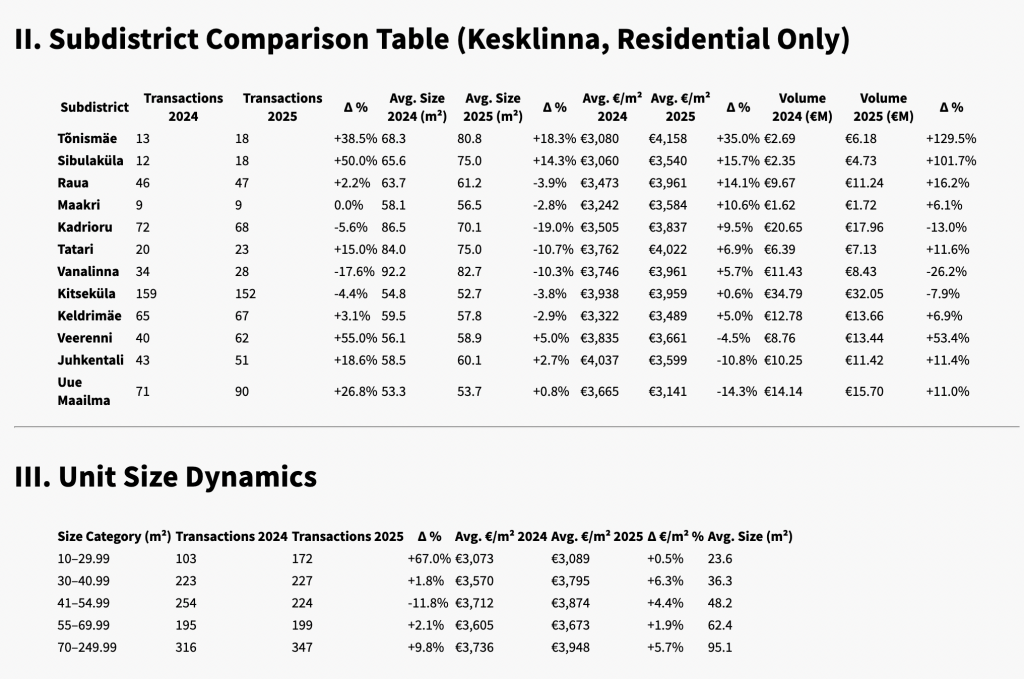

Key Observation: Large apartments (70+ m²) made up 48% of the total transaction value in 2025, underscoring strong demand for spacious properties. Small-unit sales surged by 67%, but average prices stagnated due to oversupply in select districts like Uue Maailma.

IV. Strategic District-Level Takeaways

- Top Performers by Growth:

- Tõnismäe: Highest uplift in both value (+129.5%) and price/m² (+35%). Demand centered around 80+ m² luxury units.

- Sibulaküla: Mid-sized units led to volume doubling YoY; price/m² growth at 15.7%.

- Veerenni: Transaction volume rose 55%; remains a development zone despite slight pricing dip (-4.5%).

- Correcting or Contracting Areas:

- Vanalinna: Despite €3,961/m² average price, transaction volume dropped 26.2%.

- Juhkentali: Declining prices (-10.8%) as supply shifted toward mid-range stock.

- Uue Maailma: Price fell -14.3%; over 40% of units sold were <55 m² and under €175,000.

- Affordability Zones:

- Kitseküla: One of the highest volumes, stable pricing (+0.6%), remained attractive at €3,959/m².

- Keldrimäe: Continued demand with low volatility; €3,489/m² avg., +5% price growth.

V. Strategic Outlook and Recommendations

For Investors:

- Focus on Tõnismäe, Sibulaküla, and Raua — all show consistent double-digit growth in value and €/m².

- Avoid districts with over-supplied small-unit markets unless deeply discounted.

For Developers:

- Prioritize 70–100 m² units in Veerenni and Sibulaküla. Strong liquidity and pricing potential, especially in emerging luxury segments.

For Budget-Conscious Buyers:

- Target Uue Maailma, Kassisaba, and Keldrimäe where price/m² remains below €3,500–3,700 and unit availability is strong.

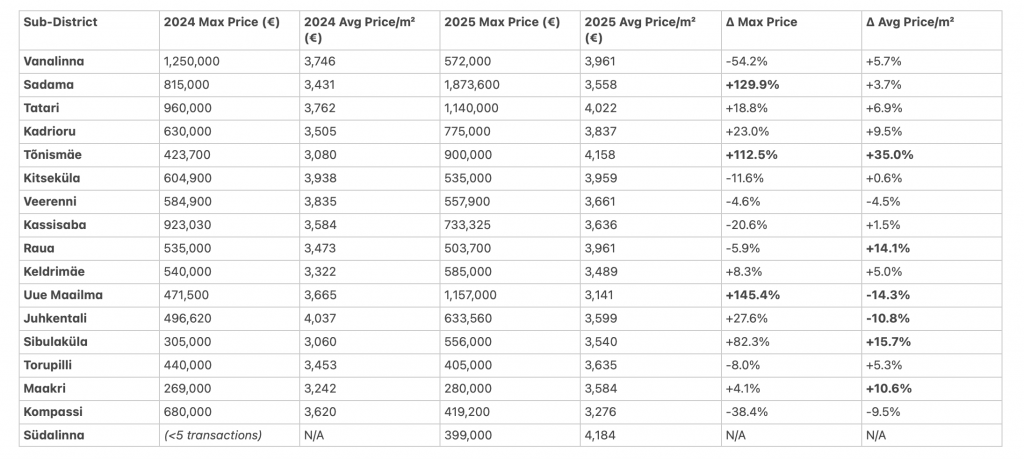

For a illustrative purposes only – the table of the most expensive transactions and average prices per m² for all sub-districts in Kesklinn; City Centre, Tallinn (Jan-Jun 2024 vs. Jan-Jun 2025):

(Jan-Jun 2024 vs. Jan-Jun 2025- Highest-priced transaction and average price per m²)

Key Observations:

- Luxury Market Dynamics:

- Sadama recorded the highest-priced transaction in first half of 2025 (€1.87M), while Vanalinna had the highest in 2024 same period (€1.25M).

- Tatari and Kadrioru maintained premium positioning with 2025 avg. prices >€4,000/m².

- High Growth Districts:

- Tõnismäe: Max price surged 112.5% YoY (€423.7K → €900K), with avg. prices up 35%.

- Sibulaküla: Max price jumped 82.3% despite being a mid-tier sub-district.

- Price Corrections:

- Uue Maailma saw a record 2025 transaction (€1.16M) but avg. prices dropped 14.3% due to increased small-unit sales.

- Juhkentali‘s avg. price fell 10.8% despite a 27.6% increase in max price.

- Consistent Performers:

- Kitseküla (152 transactions) and Keldrimäe (67 transactions) maintained stable prices (±1%).

*Data Source: Land and Spatial Development Board (Estonia); N/A = Insufficient transactions (<5).*

*Note: All prices reflect residential apartment transactions in Kesklinna, Tallinn (Jan 1 – Jun 30, 2024 vs. 2025).

Conclusion

The Kesklinna residential market in H1 2025 is characterized by resilient value growth despite a near-flat transaction count. Larger units in premium subdistricts are driving capital into the market. Investors are advised to focus on stable subdistricts showing momentum in both size and value, while maintaining caution in areas with oversupply and weak price support.

No fluff. No assumptions. Just verifiable performance data.

Transactions data source: Land and Spatial Development Board (Estonia)

Baltic Sotheby’s International Realty provides outstanding residential brokerage services to property owners, buyers, and tenants. We are market leaders within the premium residential real estate segment, and our Portfolio provides access to the best homes in Estonia. Our Team of professionals will provide optimal solutions for real estate sales, purchases, and leases.

Sotheby’s International Realty is the most visited luxury property website in the world. If you would like your property to be featured on it. List your home with Baltic Sotheby’s International Realty! Contact us via email info.estonia@balsir.com