A Realist’s Outlook for Discerning Investors, Buyers and Sellers.

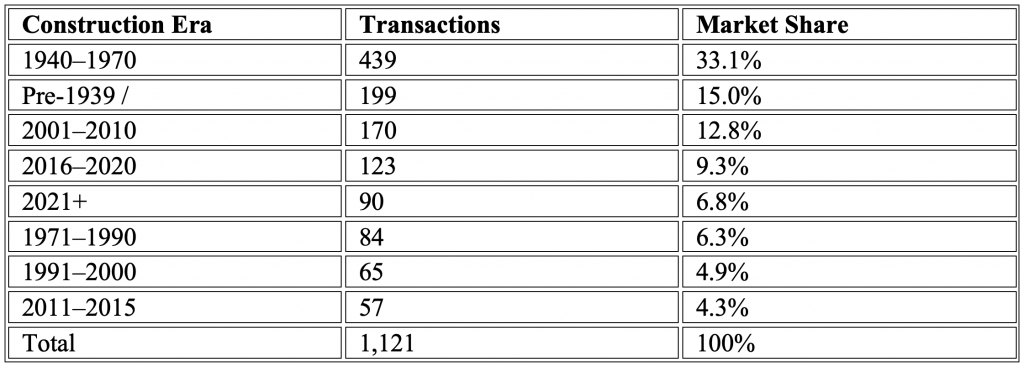

Twenty-five years + in real estate has taught our team one thing above all: numbers don’t lie, but they also don’t speak unless you know how to listen. And looking back to 2024, Tallinn’s city center — Kesklinn — had a lot to say. With 1,221 residential apartment transactions completed in our focus district during 2024, we look across eight construction eras, we’re past guesswork. This is the stage where data speaks louder than trends.*

In this review, we’ll walk you through where deals actually happened, where capital moved, which segments showed resilience or risk, and what this means for your future positioning. But this isn’t only for institutional investors. If you’re an individual considering a purchase — or you already own a well-positioned apartment in the city center — the implications are just as significant. This market rewards informed decisions on both sides of the table.

No sales pitch — just a level-headed conversation about where we are, and what it means.

The Market by Era: How Tallinn’s city center apartments really moved in 2024.

*all transactions data is based on Estonian Land Board data from 2024.

The dominant force is clear: mid-century Soviet-era apartments (1940–1970) commanded a third of the market. These aren’t glamorous properties, but they are central, functional, and priced for efficiency — with rental yields of 5–7%, they reflect a stable demand for affordable, income-generating housing stock. This is why they continue to attract capital. For volume-focused investors — particularly in the rental space — this remains the foundation of Tallinn city centre transaction engine.

Pre-1939 units made up the second-largest share, yet their impact extended beyond their numbers. These historic buildings carried exceptional volatility and upside potential. Their pricing — from €1,093 to €7,523 per square meter — swung wildly depending on renovation quality and heritage status. But with supply fixed and authenticity valued more than ever, their relevance in any serious portfolio was significant.

Price Behavior: where the money actually moved

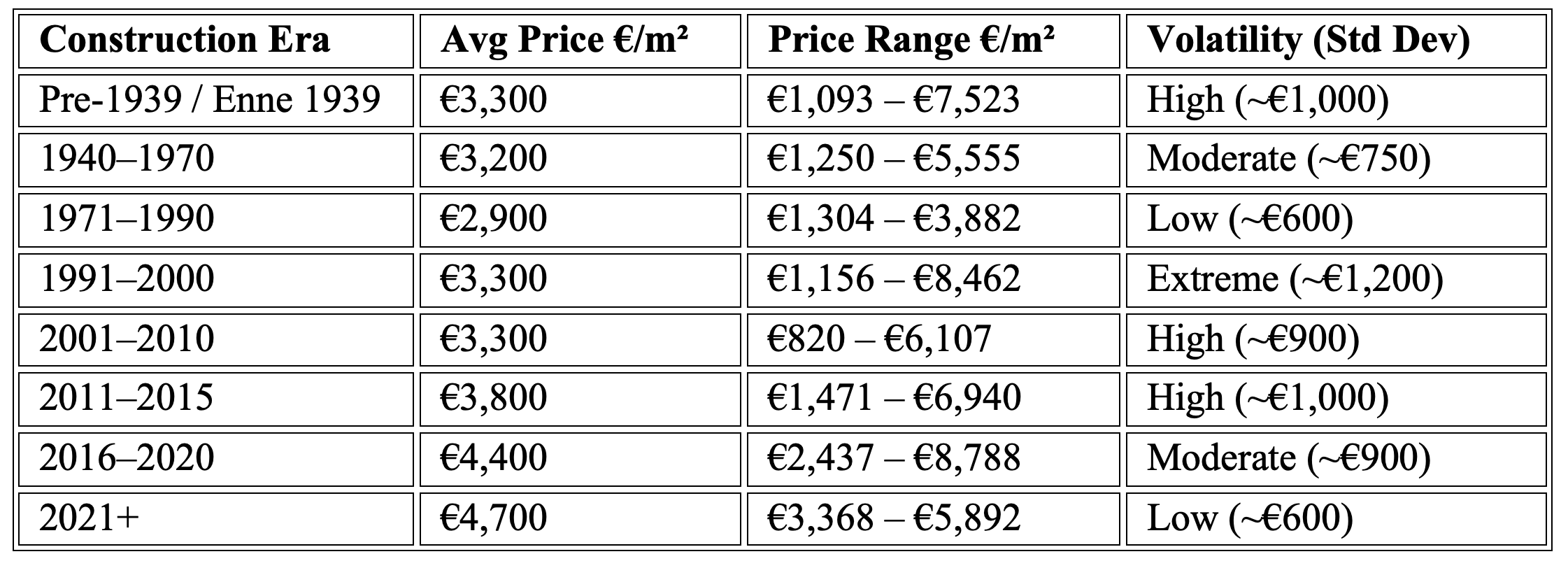

Important clarification: The 1991–2000 era was the most volatile segment in 2024, with a price spread from €1,156 to €8,462 per m² — wider than even the pre-1939 category. This inconsistency made it the riskiest era to navigate, especially for non-local or hands-off investors. Much of this volatility was due to a wide range in build quality and location, and outdated renovations masquerading as modern upgrades.

By contrast, 2021+ apartments were tightly priced — not cheap, but predictable. Their €4,700/m² average reflects investor-grade uniformity and a low-risk, low-maintenance profile.

The 2016–2020 era deserves particular attention. With a €4,400/m² average and €541M in total 2024 sales volume, this segment quietly matched the liquidity of the newer builds — but at a 10–15% discount. For many investors, it was the smarter way to access modern standards without competing at the top of the pricing band. Energy retrofit potential (aligned with EU Green Deal subsidies) also makes this cohort more future-proof than it may appear at first glance.

The Size Factor: How Square Meters Shape Value

In Tallinn’s city center, apartment size (m²) isn’t just a number — it’s a critical driver of pricing, liquidity, and buyer intent. While a year of construction sets the stage, square meters determine who buys, why they buy, and at what premium. Here’s what 2024’s data revealed:

Pre-1939: A Tale of Two Sizes

Historic apartments split sharply into two camps:

- Micro-Studios (30–50m²): Achieved record premiums (€4,200–€6,000/m²) for Airbnb-ready layouts in Old Town.

- Grand Lofts (80–120m²): Traded at discounts unless fully restored.

1940–1970: The Goldilocks Zone

Soviet-era units averaged 50–60m² — the sweet spot for rentals. These mid-sized apartments balanced affordability (€3,150/m²) with functionality, attracting long-term tenants at 5–7% yields. Too small (<45m²) risked tenant turnover; too large (>70m²) dragged down returns with heating costs.

Modern Shrinkflation: Smaller, Pricier, Faster

Newer builds shrank 12% since 2011:

- 2021+ units averaged 65m² vs. 2011–2015’s 80m².

- Compact 50m² studios near sold fastest (€5,892/m²), catering to tech workers prioritizing location over space.

The Oversized Trap

Legacy stock from 2001–2010 (80–110m²) struggled. Despite similar pricing to modern builds (€3,300/m²), these units lingered 40% longer on the market. Buyers penalized bulk with -3% price discounts — a warning for holders of large, unrenovated units.

Key Takeaway:

Size dictates strategy. Smaller units (<70m²) drove liquidity; larger units (>90m²) demanded niche buyers. Savvy players matched square meters to neighborhood demand — or paid the price.

Size and era intersect to shape capital flows. While pricing signals drew attention, square meters quietly determined where money pooled — and where it stalled.

Where the capital was concentrated

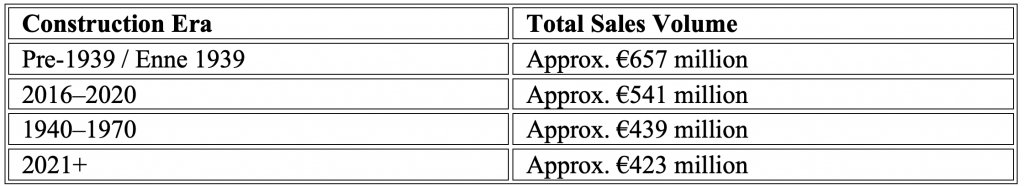

These volumes reflect closed transactions — not forecasts. Although pre-1939 properties accounted for only 15% of deals, they brought in the highest aggregate capital in 2024. This confirms what seasoned professionals know: high-quality old builds are not commodities — they are strategic assets. Buyers here were not chasing yield, but securing legacy, prestige, and location security.

The 2016–2020 stock emerged as a hidden heavyweight, bringing in over €500M in transactional value — often overlooked due to its quieter profile. Meanwhile, 2021+ deliveries remained expensive and slow-moving. Looking ahead, the Estonian Land Board confirms more than 1,200 new units are in the central pipeline for 2025–2026, raising the question of future saturation.

Outlier-Adjusted Pricing: the quiet distortion

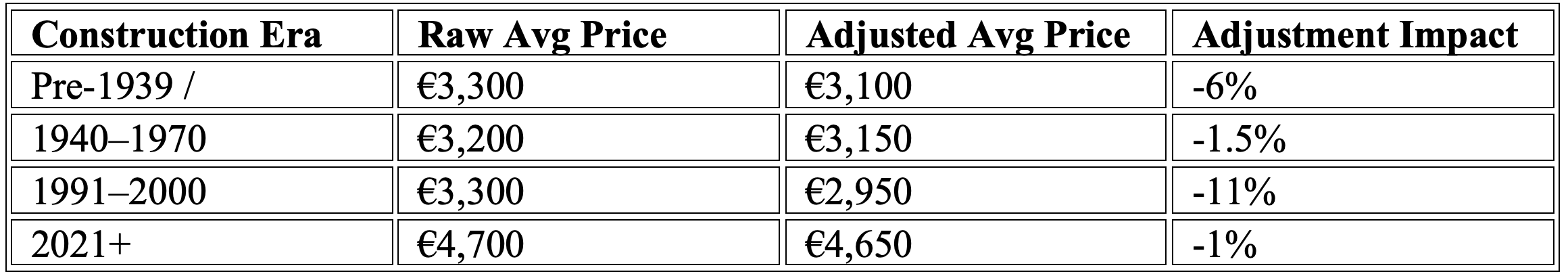

What happens if you remove the top and bottom 5% of prices per era? You begin to see the real shape of the market — especially in volatile segments.

Caution: The -11% adjustment in the 1991–2000 segment is critical. Raw averages in this category were genuinely misleading, with a handful of anomalous high-end sales masking a largely mid-tier market. Unprepared buyers risked overpaying by a wide margin.

Across the board, pre-1939 remained robust even after trimming — its adjusted price still hovered around €3,100/m². Yet that figure hides one major caveat: renovation costs of €1,000–€2,000/m² can quickly erode margins if not properly forecasted and managed.

Why Quality Old Builds Still Command Respect — and Price

If you’re a current owner of a well-maintained or restored apartment in a pre-1939 building — particularly in areas like Old Town, Kadriorg, or Kassisaba — you hold a category of asset that is quietly irreplaceable. And that mattered more than ever in 2024.

Let’s be clear: old builds in prime areas with solid architectural merit aren’t just holding value — they are increasingly functioning as a market hedge. Their relevance is increasing, not fading, especially among a rising class of end-users and long-term investors looking for authenticity, quality, and permanence.

That said, not all pre-1939 units are equal. While buildings in the Old Town, Tatari, and Kentmanni corridors continue to see high demand, peripheral stock (e.g., in Kalamaja) now faces real competition from clean, modern builds that offer similar price points with better energy ratings.

For Sellers: what you might not know about your apartment’s market position

If you’re holding a pre-war apartment in excellent condition — particularly one already upgraded to energy Class C or better — you’re in a unique position. Despite market caution elsewhere, 2024 data showed that quality pre-1939 homes transacted quickly and above expectation when priced intelligently and marketed correctly.

This isn’t just sentimental real estate. These are rare, high-performance cultural assets. If you’re selling, now is the time to lead with data, not guesswork.

For Buyers: Why buying premium for old builds still makes sense

High-quality, restored pre-1939 units are not overpriced nostalgia — they are resilient, highly rentable assets with appreciation potential.

- Their land positions are central and irreplaceable

- Renovation quality is increasingly standardized

- Cultural and lifestyle demand is persistent

- The resale pool is deep and international

- Prioritize 50–80m² units — small enough for efficiency, large enough for livability. Oversized stock (>90m²) risks energy-cost penalties unless heritage-backed.

In short: when the market moves, these apartments move with grace — not panic.

Investment Profiles: What strategy fit which segment in 2024

| Strategy | Best Fit Era | Rationale |

| Value Flip | Pre-1939 | Avoid renovation overruns; balance family appeal and efficiency. |

| Rental Yield | 1940–1970 | Predictable cash flow, stable tenants |

| Long-Term Hold | 2021+ | Low volatility, low maintenance, green-certified units |

| Hidden Value | 2016–2020 | Comparable quality to 2021+ at 10–15% discount + retrofit potential |

Avoid overexposure to 1991–2000 and 1971–1990 without deep due diligence and local execution teams.

Final Word: Two Audiences – One Philosophy!

Whether you’re buying a home, selling a valuable apartment, or allocating investment capital — Tallinn’s city center in 2024 rewarded precision, not speculation.

- Buyers needed to understand pricing signals and navigate hidden value.

- Sellers needed to correctly position high-quality old stock for serious demand.

- Investors were rewarded when balancing yield with volatility and tracking building quality — not just year of construction.

This market didn’t just move — it matured. And in Tallinn, that favors those who move with clarity, not crowd-following.

If you’re navigating either side of the transaction — as a seller or buyer — the advantage comes from insight, timing, and a clear plan. That’s where our work begins. Contact us for a confidential consultation – we offer discreet, data-led consultations tailored to both individual owners and institutional investors.

Rauni Tillisoo

Sales Associate / Investment properties

rauni.tillisoo@balsir.com

+372 5323 2294

Baltic Sotheby’s International Realty Estonia