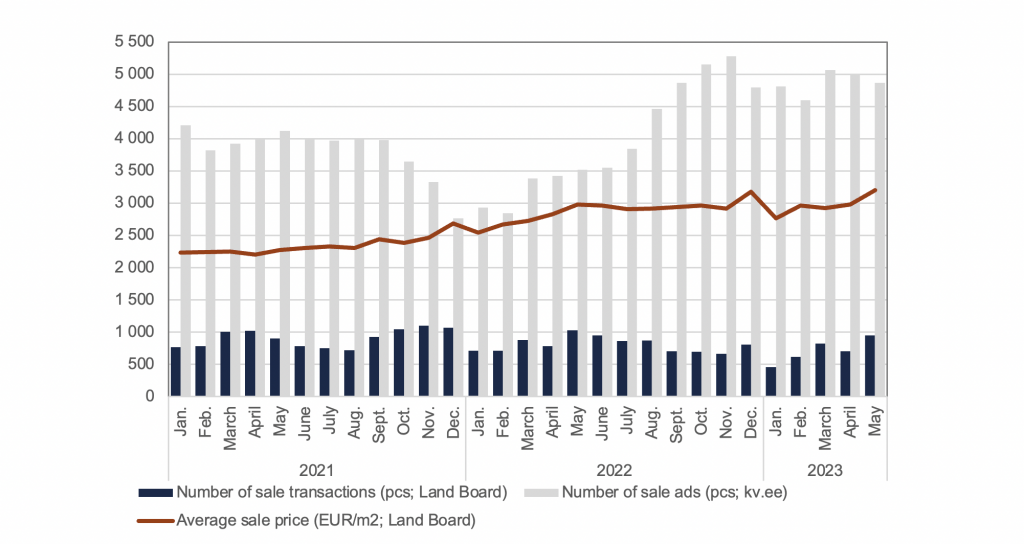

The sale transaction information is derived from the property statistics published by the Land Board, and information on sale ads from the kv.ee property portal.

In January, 457 apartments were sold in Tallinn, which is a record low number in the recent years. In February, the number of sale transactions rose to 617 and in March by more than 200 to 827. In April, there was a small downturn with 702 sale transactions conducted; however, in May, the number of transactions increased sharply to 947.

The average number of transactions in the first five months of 2023 was thus 710 per month compared to 805 in 2022 and 907 in 2021.

The fluctuation in the number of transactions is quite significantly affected by the formal arrangement of sales in newly developed apartment blocks. The finalisation of sale transactions (transfer of ownership) of apartments in a newly finished apartment block usually takes place within one to two months after the completion of the block. Most of those transactions have actually been agreed on a year or two earlier which is why the price level of those apartments does not reflect the current state of the market. When the market is on the rise, the finalisation of such transactions takes place at a price level lower than that of similar apartments on sale at the time; when the market has turned down, the situation is opposite.

The first months of this year saw approximately 110 to 320 finalisations of sale transactions of new apartments per month with their share being 24–34% of the total number of sale transactions.

In December last year for the first time, the average sale price of apartments per square metre exceeded EUR 3,000 – the exact number being EUR 3,178 per square metre. In January this year it came down a little and was EUR 2,762 per square metre; in February it reached the level seen at the end of last year – EUR 2,965 per square metre. It stayed at that level for another two months (in March EUR 2,927 and April EUR 2,976 per square metre) and hiked up in May when the average price per square metre rose to EUR 3,206.

As described above, the price mainly increased due to the share of previously agreed sales of new apartments in the total number of transactions. Since the end of last year, a significant portion of apartment sales finalised concern the apartments in developments of higher price range (such as those in Kalaranna, Vesilennuki and Uus-Volta streets). Furthermore, the share of finalisation of sales of new apartments in May was the highest in recent months.

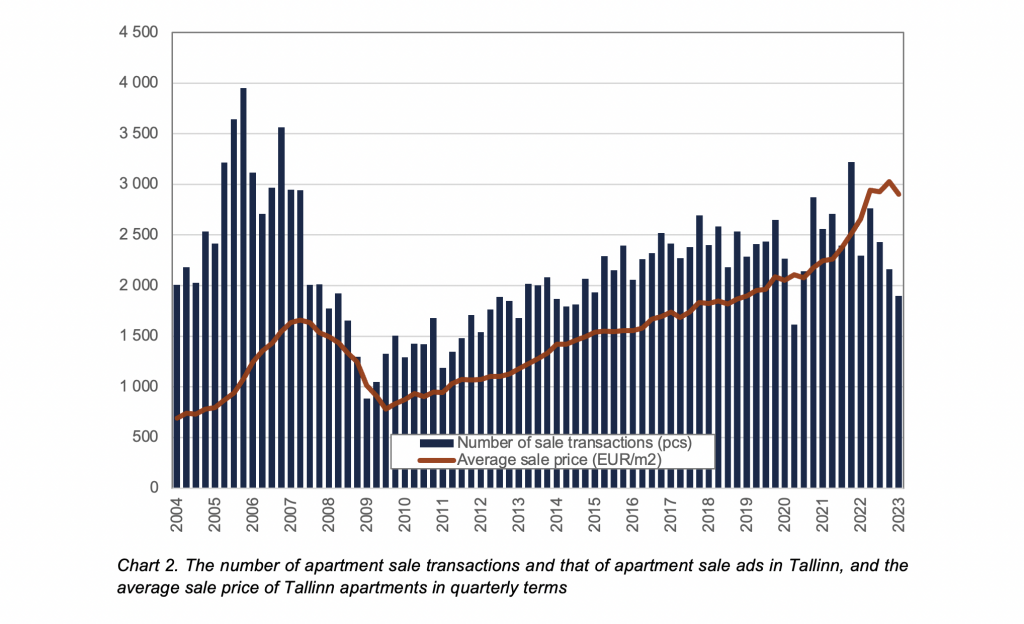

In quarterly terms, 1,899 apartment sale transactions were conducted in Tallinn in the first quarter of this year. Disregarding the second quarter of 2020 which was highly affected by the lockdown measures due to COVID-19, the last time the number of transactions fell below 2,000 was the first quarter of 2015 (1,931).

Within the first five months of the year, 92 apartments were sold at a sale price of EUR 500,000 or higher; 63 of those transactions consisted in the finalisation of apartments sold in new developments, and 29 were conducted on the secondary market.

Seven transactions were conducted at a sale price of EUR 1 million or more, six of those pertained to the finalisation new apartments. The most expensive transaction on the secondary market was conducted at the price of EUR 1.05 million.

It should be noted that all the apartments of higher price range sold on the secondary market were also located in newly built apartment blocks or those completed only a couple of years back.

There are currently nearly 220 apartments for sale at a price of more than EUR 500,000, of which 15 exceed the price of EUR 1 million. The most expensive of them is an apartment of approximately 235 m2 in a recently built apartment block in Kadriorg, which is offered for sale at EUR 2.2 million.

We prognose the number of apartment transactions during the summer months to remain close to the average level seen at the beginning of the year: around 700–750 per month. In the autumn, the transaction activity on the secondary market should slightly increase; however, the total number of transactions will also be affected by the completion of apartments currently under construction, and the finalisation of their sale.

The sale periods of new apartments will certainly be longer, but we do not predict any significant change (reduction) in the sale prices. A row of various, mainly marketing campaigns will be seen, which mainly offer free additions (such as furnishings, storage rooms, parking spaces, etc.) to those buying apartments.

Since during the last year, fewer new developments have been taken on than before and the sale pace of new apartments has slowed, the total number of transactions will be affected by these factors, as well.

The sale prices of units in older apartment blocks are under severe pressure and they are expected to go further down in the coming months.

Both of the above aspects will probably cause a fall in the average sale price per square metre after the sales of new apartments already finished and to be finished within the near future are finalised.

All in all, it is the buyers’ market at the moment and there are a great many offers. Sale periods are therefore extended and transactions will be closed mainly on justly priced objects. The time of emotional buying and fast decisions is over (for now).

URMAS TEHVER

Market Research & Advisory

+372 513 1410

urmas.tehver@balsir.com